FAQs

Donors

RoundUp.org is how you turn everyday purchases into reliable, monthly, recurring support for your favorite nonprofit - making generosity a simple, automatic part of your daily life.

RoundUp.org is an Approved Financial Partner of Visa and Mastercard that enables donors to designate their Visa/Mastercard to round up every purchase for any nonprofit you choose (even your local school, church, or pet shelter that impact your local community) - turning any Visa or Mastercard into a daily force for good.

Isn’t it time to stop rounding up for the charity chosen by your grocery store, and start rounding up for the nonprofit you care about most?

-

What is RoundUp.org?

RoundUp.org is an approved financial partner of Visa and Mastercard that lets you automatically round up everyday credit-card purchases and donate your spare change to any nonprofit you care about. It is the only platform that directly links your credit card to a nonprofit of your choosing, turning everyday spending into predictable, recurring impact.

-

How does RoundUp.org work?

Choose a nonprofit on RoundUp.org and link an eligible Visa or Mastercard and go about your normal spending. Each purchase rounds up to the next dollar. On the 1st of each month, your card is charged once for the total round ups accrued during the prior month. Your donation is then distributed to your selected nonprofit through Our Change Foundation, a U.S. 501(c)(3) donor-advised fund.

-

How do I choose a nonprofit?

You can search for a nonprofit on RoundUp.org or use a nonprofit’s unique link or QR code to access their listing directly.

-

Can I change the nonprofit I support?

Yes. You can change your supported nonprofit at any time. Your donation will go to the nonprofit selected as of the last day of the month.

-

Can I round up for multiple nonprofits?

Currently, RoundUp.org supports giving to one nonprofit at a time, but you may switch nonprofits whenever you like.

-

Can I get other people to round up for my favorite nonprofit?

Absolutely! Every nonprofit listing on RoundUp.org offers easy ways to share a link to the listing via social media, email, text, or even via a QR code. Regardless of how you spread the word, all links will take prospective donors back to your favorite nonprofit’s listing, where the donor can sign up and join the cause!

-

Which card should I enroll?

Enroll your primary spending card - a Visa or Mastercard. That will ensure that more of your purchases will share spare change with your favorite nonprofit.

-

How much will I donate each month via rounding up?

It depends on your spending. Most donations end up being between $25 and $35 per month, but you can always set a monthly ‘cap’ on the donation amount, and it will never exceed your budget.

-

Will the nonprofit know that I have made a donation?

It's totally up to you. You can choose to donate anonymously or share your details with the nonprofit, including your name and email address.

-

Can I set a maximum monthly donation?

Yes. You can set, change, or remove a monthly cap at any time. Your donation will never exceed the cap you set.

-

Is there a minimum monthly donation?

Yes. There is a $10 minimum monthly donation. If your accrued round ups total less than $10 in a given month, your card will be charged the $10 minimum.

-

What happens if my purchases don’t generate enough round ups?

If your round ups total less than $10 for the month, the $10 minimum donation applies.

-

What happens when a purchase ends in $.00?

If a purchase already ends in $X.00, the round up amount will be $1.00 for that transaction.

-

When will my card be charged?

Your card is charged once per month, typically on the 1st of the calendar month, for the total round ups from the prior month.

-

What does the charge look like on my statement?

Charges appear as ROUNDUP.ORG

-

Are my Round ups tax-deductible?

Yes. Donations are made to your selected nonprofit through Our Change Foundation, a registered 501(c)(3) donor-advised fund. You will receive a tax receipt each month once your donation is processed and receipts are always available on your online account dashboard.

-

Can I donate anonymously?

Yes. You may choose whether or not you want to share your name and email with the nonprofit. This setting can be changed at any time from your ‘User Settings’.

-

How secure is my information?

All cards are tokenized and stored in a PCI Level 1 compliant vault. Card details are encrypted and anonymized. Neither RoundUp.org nor the nonprofit can see your purchases.

-

Will RoundUp.org or the nonprofit know where I shop?

No. Transaction data is anonymized and limited. Individual purchase data is limited to the category of the purchase (e.g. “Travel”), and the last 2 digits of the amount in order to calculate the round up amount.

-

What happens if my card is declined?

If a charge fails, RoundUp.org will retry. If it continues to fail, your account will be paused until you update your payment information.

-

Why doesn’t RoundUp.org work with PayPal, Venmo, or American Express?

Today, only Visa and Mastercard provide the transaction-level data required to calculate round ups accurately.

-

How does RoundUp.org cover its costs?

RoundUp.org retains $2 per monthly donation (averaging $32) to operate the platform. Nonprofits never pay to participate. After fees, nonprofits typically receive 85% of the donation.

-

What happens if my nonprofit becomes ineligible?

If a nonprofit becomes temporarily or permanently ineligible due to compliance requirements, you’ll be notified and given the opportunity to change your designated nonprofit.

-

How do I change my enrolled credit card?

You can update your enrolled card anytime from your online account dashboard.

-

How do I pause or cancel round ups?

You can pause or cancel at any time from your online account dashboard. There are no contracts or penalties.

Nonprofits

What if consumers could choose the nonprofit they want to “round up for”, instead of accepting whatever nonprofit the store chose for them? And what if they rounded up every purchase they made with their credit card for your nonprofit?

The result would be automatic, meaningful, recurring monthly donations for your nonprofit organization - without having to throw another gala, run a silent auction, or sell merchandise. Your nonprofit could spend more time and energy on making an impact, rather than chasing donations.

Automatic, recurring donations are now the “bullseye” goal for nonprofits and nonprofit boards. RoundUp.org is revolutionizing recurring giving, and making generosity a simple part of everyday life for donors who want to give back with every purchase they make.

-

What is RoundUp.org?

RoundUp.org is An Approved Visa and Mastercard Financial Partner that enables donors to designate their round ups to go to any nonprofit they choose* - including local nonprofits that directly impact their communities. Donors can sign up in less than a minute and designate their Visa/Mastercard to any nonprofit in the RoundUp.org listing directory. Once designated, RoundUp.org automatically calculates the round up amount for every transaction made on that credit card, and charges the donor for a single donation, one time, at the end of the month - sending that money to the nonprofit of their choice through Our Change Foundation, a 501(c)(3) donor-advised fund that is purpose-built to distribute donations to nonprofits of any size. Nonprofits register for free with Our Change Foundation to receive their funds via ACH or a mailed check.

-

Why was RoundUp.org created?

RoundUp.org was created to help nonprofits grow recurring donations, and to help donors give painlessly to their favorite nonprofit month-in and month out. Recurring donations provide predictable, reliable funding and allow nonprofits to focus less on fundraising and more on delivering impact. RoundUp.org leverages the familiar “round up for charity” behavior that 97% of donors already understand.

-

Do nonprofits need to sign up to use RoundUp.org?

No. All U.S.-based 501(c)(3) nonprofits that are in good standing with the IRS already have a listing page on RoundUp.org and donors can choose the one they want to support with their preferred Visa/Mastercard.

-

How does RoundUp.org work for nonprofits?

Donors choose one nonprofit to support with their round ups, and securely enroll their Visa/Mastercard. RoundUp.org charges the linked card one time for the total amount of the round ups from purchases made during the month. That monthly donation is distributed to the donor’s chosen organization through Our Change Foundation, a 501(c)(3) donor-advised fund that is purpose-built to distribute donations to nonprofits of any size. Nonprofits register for free with Our Change Foundation to receive their funds via ACH or a mailed check.

-

How many nonprofits can a donor support at one time?

Each donor may support one nonprofit at a time, but they can change their selected nonprofit at any time.

-

How much do donors typically give?

Based on credit card data, spare change from rounding up every purchase typically ranges between $25–$35 per month, though results vary, and donors can set a monthly cap on the donation amount.

-

Can donors set a maximum monthly donation?

Yes. Donors can set and adjust monthly caps at any time.

-

Is there a minimum monthly donation?

Yes. The minimum is a $10 gross donation. This amount will be charged if the donor’s accrued “spare change” round ups don’t meet or exceed $10.

-

Do we need a website, a developer, or special tools?

No. RoundUp.org provides a ready-to-go nonprofit listing page with a unique URL and QR code that can be used on your website, in your donation software (‘thank you page’, for example), and shared via email, print, events, or social media.

-

Can we add RoundUp.org to our existing donation page or materials?

Yes. Your RoundUp.org page URL never changes, and QR codes can be used on websites, mailers, signage, and events.

-

Is it safe for donors to enroll their cards?

Yes. All cards are tokenized and stored in a PCI Level 1 compliant vault. Card details are encrypted and anonymized, and neither RoundUp.org nor nonprofits can see individual purchases.

-

Can donors track how much they’ve given?

Yes. Donors receive monthly summaries, tax receipts, and can view their full giving history in their online account dashboard.

-

Why can’t I see my new donors in my portal on Change?

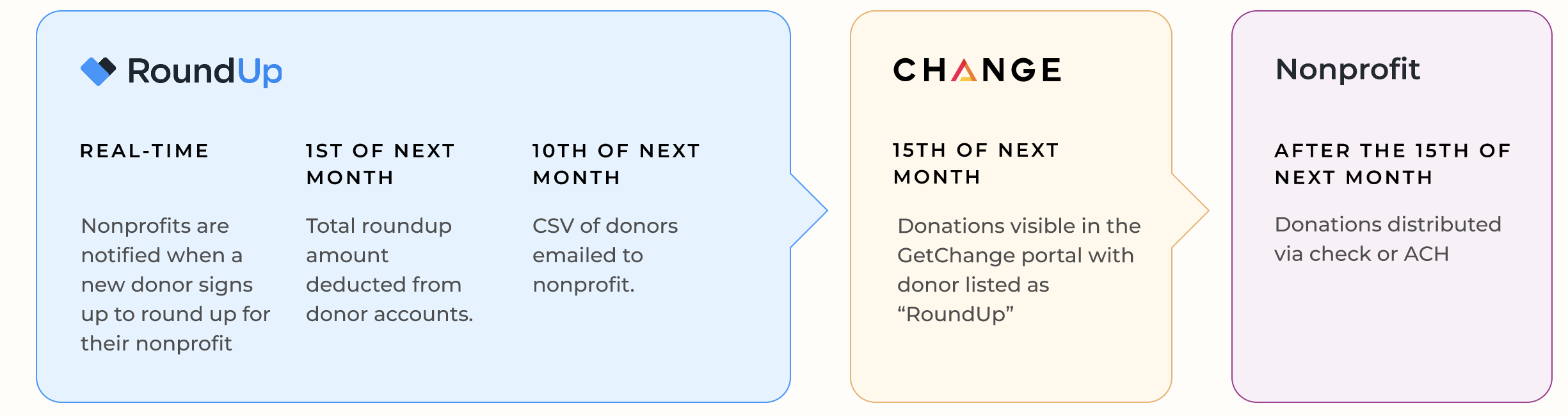

While RoundUp.org notifies nonprofits in real time when a new donor signs up, we only charge donors' cards once a month for the total of their rounded-up transactions incurred during the prior month. After donations are processed, we send a CSV file to the nonprofit admin email addresses on file that includes the donation and donor name and contact information. On or after the 15th of the month, you’ll see your “RoundUp.org” donations in the Change portal.

-

When does our nonprofit receive donations?

Donations are distributed monthly by Our Change Foundation. This typically occurs on about the 15th of each month, but can vary. Nonprofits register once to receive funds via ACH or (if preferred) by check by mail.

-

How much will our nonprofit receive?

Nonprofits typically receive 85% of the gross donation amount. RoundUp.org retains $2 per monthly donation (avg of $32) to operate the platform. The Donor Advised Fund pays out all expenses, including: credit card transaction fees and fees for managing credit card transaction data.. This is accounted for in the 85% average. Nonprofits never pay anything to participate, and RoundUp.org only earns a fee if a donation is made.

-

Are donations tax-deductible?

Yes. Donations qualify for tax deduction as allowed by law. Tax receipts are provided directly to donors.

-

Will we receive donor information?

Yes. Each month, nonprofits receive an email summary and downloadable CSV file with donor names (unless a donor chooses anonymity), email addresses, and donation amounts. This typically comes out on about the 10th of each month, after credit cards have been charged and updated with new expiration dates, etc.

-

Can we use RoundUp.org with our CRM?

Yes. The monthly CSV file can be uploaded into most donor CRM systems.

-

How do we get more donor sign-ups?

Share your RoundUp.org listing page URL via dedicated emails, social media, your website, your donation ‘thank you’ page, and at events. Create specific campaigns to get people rounding up for your nonprofit. The most effective campaigns combine the following elements:

- Dedicated email series (specific to rounding up, and only about rounding up for the nonprofit

- A time-bound campaign: “Start rounding up for us in the next 7 days

- With an incentive: “For every donor who starts rounding up in the next 7 days, there is a group of donors who will provide $100 ‘bonus’ to our nonprofit. So, sign up during the 7-day window to maximize your round ups!”

-

What if a donor already enrolled their card for another nonprofit?

Each Visa or Mastercard can only be enrolled for one nonprofit at a time, so early outreach is important before a donor links their card to another nonprofit.

-

What is the Nonprofit Admin Portal?

The Admin Portal allows authorized representatives to manage and update their nonprofit’s RoundUp.org listing page, including their nonprofit name, logo, mission statement, etc.

-

How can we update or customize our listing?

Listings can be customized through the Admin Portal. To access the admin portal, log in from the site or through your listing page and follow the verification instructions. To complete verification, you’ll need to have access to an email address @domain that matches your organization’s website address on file.

-

How do we access the Admin Portal?

To access the admin portal, log in from the site or through your listing page and follow the verification instructions. To complete verification, you’ll need to have access to an email address @domain that matches your organization’s website address on file.

-

How do we remove our organization’s listing?

You may request removal by contacting support@roundup.org. Removal stops future donations but does not affect previously distributed funds. But, why would you want to block anyone from assigning your nonprofit to their Visa/Mastercard?

-

Is there a cost to manage our nonprofit listing?

No. There is no cost to access or use the Admin Portal

-

How do nonprofits get help?

Contact us at support@roundup.org.

-

What if our nonprofit is listed as ‘ineligible’ on RoundUp.org?

Eligibility is determined by checks conducted by Our Change Foundation. To learn more about why your specific is listed as “ineligible,” contact support@getchange.io.

Don’t see the answer to your question here? Contact us support@roundup.com.